Recent Select Transactions

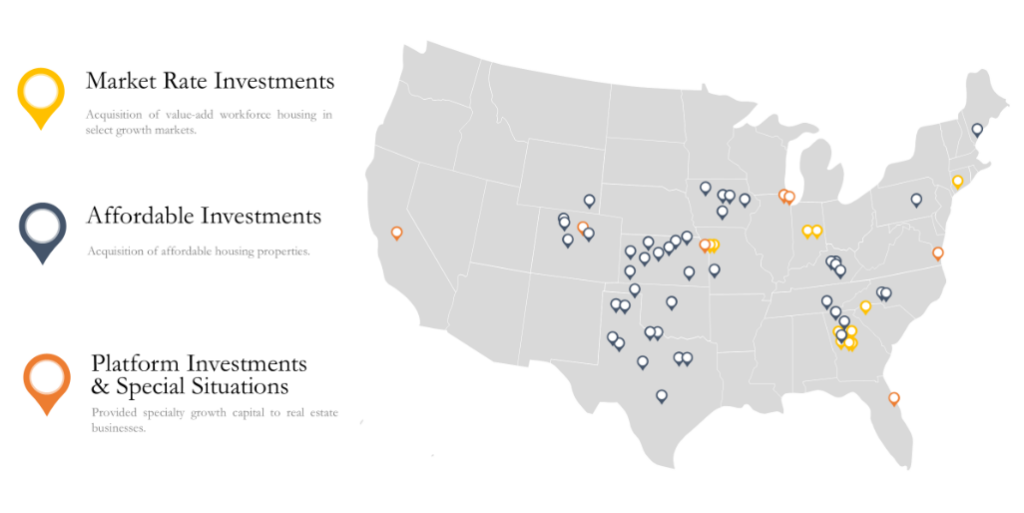

Investments across the spectrum of equity and debt.

Acquisition of affordable multifamily housing

Acquisition of Project Based Section 8 and LIHTC assets across country

Affordable housing platform in Midwest

Partnered with existing management to recapitalize an affordable housing development company, allowing for further growth and generational transition. Acquired the GP interests of a portfolio that was financed by Low Income Housing Tax Credits.

Debt for Australian manufacturing company

Provided growth capital for an international company through a loan collateralized by a portfolio of industrial facilities in Colorado.

Retail REIT balance sheet infusion

Injected capital into a publicly traded strip center REIT to help management in restructuring its capital stack.

Acquisition of workforce multifamily housing

Investing in high growth markets with stable and improving yields, primarily in the Southeast and Midwest.

Single family home portfolio in an appreciating MSA

Acquired and repositioned a specialty SFR portfolio in the Atlanta MSA.

Structured facility for residential rehabber

Entered into programmatic joint venture with institutional "fix-and-flip" residential investor in the Midwest, providing equity and debt capital for 100+ home portfolio.